Recent Articles

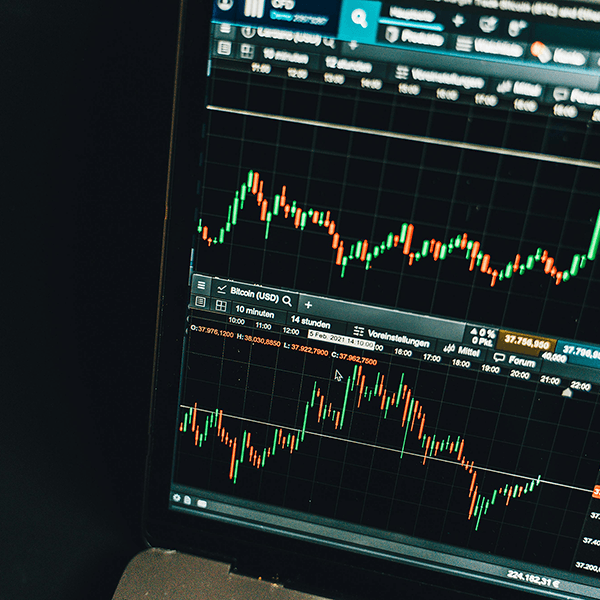

Fed Cuts Again, But Dot Plot Steers Mortgage Rate Outlook

The Fed cut rates by 0.25% and ended quantitative tightening, but the real story for the average 30-year fixed is in the dot plot and Powell’s comments. Here’s what that means for mortgage rates and homebuyers.

Published on 12/10/2025

This Week in Mortgage Rates: Buyers Are Back as Rates Hover in the Low 6s

Mortgage rates bounced around but stayed in a tight range near the low 6% area this week, while purchase applications hit their highest level since early 2023 and refinance demand more than doubled compared to last year. Here’s what that means if you’re thinking about buying or refinancing.

Published on 12/06/2025

Stronger Data Last Week Caused a Slight Rate Bump

Stronger jobless-claims and durable-goods data from last week pushed the average 30-year fixed slightly higher, but mortgage rates are still near recent lows. Here’s what that means for buyers and homeowners

Published on 12/01/2025

What Today’s Jobs Report Means for Mortgage Rates

Mortgage rates held steady after a mixed jobs report, with unemployment rising and job growth coming in stronger than expected. Learn what this means for homebuyers and what to watch next.

Published on 11/21/2025

50-Year Mortgages? Here’s What You Need to Know

The Trump administration says it’s exploring 50-year mortgage options to help with affordability. Learn what this could mean for homebuyers, monthly payments, and long-term costs.

Published on 11/11/2025

Fannie Mae’s Big Update: You May Qualify Even With a Credit Score Below 620

Fannie Mae’s new credit score policy lets lenders use automated approvals even for borrowers below 620. Here’s what that means for homebuyers who thought they couldn’t qualify.

Published on 11/08/2025

What’s Going On With Mortgage Rates? (Explain-It-to-a-5th-Grader Version)

Mortgage rates dipped, then jumped after the Fed’s cut. A $15B corporate bond sale and stronger economic reports added pressure. Here’s the simple, kid-level way to understand what’s happening and what it means for buyers.

Published on 11/06/2025

Understanding Rising Mortgage Rates Amid Federal Rate Cuts: Key Insights for Homebuyers

Are rising mortgage rates leaving you uncertain? Discover strategic insights to navigate today’s market and make informed decisions for your homebuying journey.

Published on 10/30/2025

Mortgage Rates Jump After the Fed’s Rate Cut — Here’s Why

The Federal Reserve cut rates again, but mortgage rates actually rose. Learn why this happens, what Powell said, and what it means for homebuyers.

Published on 10/29/2025

Mortgage Rates Hold Near Yearly Lows as Market Awaits Next Data

The average 30-year fixed mortgage rate is hovering near 3-year lows as bond markets hold steady amid limited economic data. Learn why rates remain low and what could move them next.

Published on 10/22/2025

Gen Z and the Dream of Homeownership: Adapting to a Challenging Market

A new Realtor.com survey reveals that 1 in 5 Gen Z adults say housing affordability is their top life concern. Learn how young buyers are adapting, saving, and staying determined to achieve homeownership.

Published on 10/15/2025

“Decoding DSCR Loans: Your Key to Hassle-Free Home Buying Adventures!”

Struggling with traditional loan requirements? Discover how DSCR loans simplify the process, making it easier for you to secure your dream home without stress.

Published on 10/14/2025

Mortgage Rates Tick Up Slightly as Bonds Weaken and MBS Underperform

On October 9, 2025, the average 30-year fixed mortgage rate edged slightly higher to 6.38% after a weaker 30-year Treasury auction and mild MBS underperformance. Rates remain stable within a narrow range as the government shutdown continues.

Published on 10/10/2025

Mortgage Rates Holds Steady After Weak Jobs Report

On October 1, 2025, the average 30-year fixed mortgage rate held at 6.37% after weak private payroll data. Bigger shifts may follow when the delayed government jobs report is released.

Published on 10/01/2025

Understanding Mortgage Rates: Why They Didn't Fall After the Fed Cut

Confused about why rates aren't dropping even after a Fed cut? Don’t worry! We’ll break it down and show you how to snag the best deal for your dream home.

Published on 09/30/2025

3 Reasons Home Affordability Is Improving This Fall

Affordability is finally improving this fall thanks to lower average 30-year fixed mortgage rates, slower home price growth, and rising wages. Learn why now could be the right time to buy.

Published on 09/26/2025

Mortgage Rates Hit Yearly Lows—Then Jump After the Fed Cut. Here’s What Happened (and Why Applications Just Surged)

After touching yearly lows early in the week, the average 30-year fixed rose following the Fed’s rate cut—thanks to the dot plot and Powell’s comments. Still, mortgage applications just saw their biggest weekly jump since 2021 as homeowners reacted to earlier rate declines. Here’s what it means for buyers and homeowners.

Published on 09/19/2025

Mortgage Rates Near 11 Month Lows—What’s Next With the Fed?

The average 30-year fixed is holding near the lowest levels since October 2024 after a weak jobs report and cooler inflation. Here’s why—and what to watch at next week’s Fed meeting.

Published on 09/12/2025

Why Mortgage Rates Move: What Every Homebuyer Should Know

Mortgage rates are holding near 10-month lows—but don’t assume they’ll stay there. Learn why rates move, what drives them, and what smart buyers and homeowners should do next.

Published on 09/03/2025

Mortgage Rates Holding Steady… For Now

After Powell's Jackson Hole speech, mortgage rates hit their lowest levels since Oct 2024. But don’t get too comfortable—more movement could be coming after Friday’s inflation data and next week's jobs report.

Published on 08/27/2025